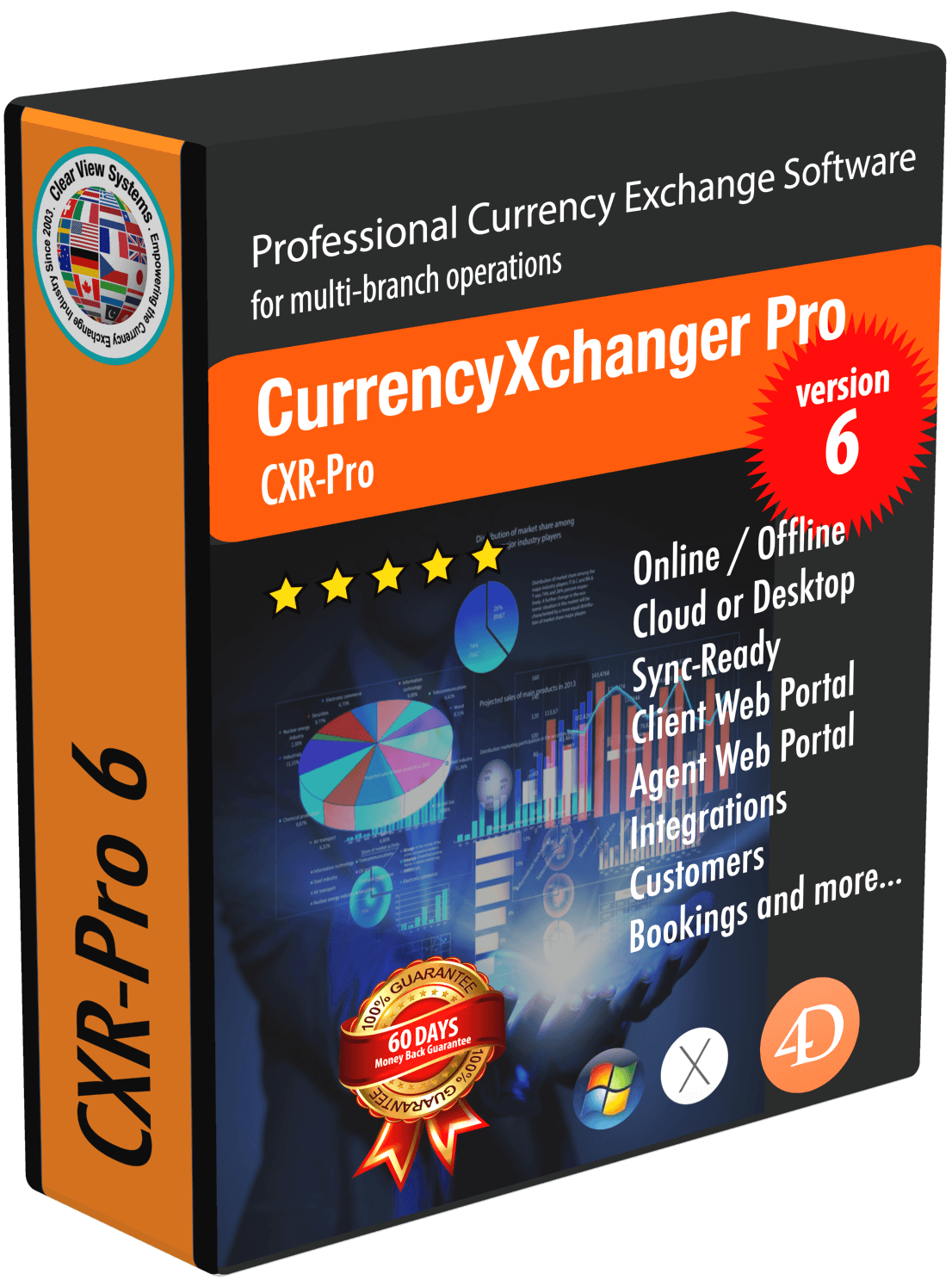

CurrencyXchanger Pro with eWire Money Remittance (CXR-Pro)

CurrencyXchanger Pro (CXR-Pro) offers all the features of the Business Edition plus some specific online remittance functionality. CXR-Pro is made for foreign exchange businesses who offer Money Remittance service through their own network of international remittance agents. The online eWire module allows agents to connect to the head office via a web interface. This interface makes it possible for a hastle-free communication between the agents, customers, and the head office. Customers will also benefit from a web interface allowing them to track their payable and receivable eWires.

What is eWire Remittance Technology?

Some foreign exchange bureaus offer money remittance service (international money transfer) through their own network of trusted agents. The benefits of having a trusted agent to remit money as opposed to the traditional remittance companies (such as Western Union or MoneyGram) is the ability to offer highly competitive rates to your customers.

eWire could also be used for Hawala-style remittances. Hawala (Arabic: meaning transfer), (also known as hundi) is an informal value transfer system based on the performance and honor of a huge network of money brokers, which are primarily located in the Middle East, North Africa, the Horn of Africa, and South Asia. It is basically a parallel or alternative remittance system that exists or operates outside of, or parallel to traditional banking or financial channels. In some nations hawala is illegal and in others the activity is considered a part of the “gray” economy. It is important that you make sure using this style of money transfer is legitimate and acceptable in all countries where you operate.

The benefit of using a system like CXR-Pro is that it allows for these transfers to be recorded according to an internationally acceptable KYC (Know-Your-Customer) and CIP (Customer Identification Program). Another benefit of using eWire as opposed to the traditional fax and email system is the tight integration of the payment orders with the Integrated Accounting module in CurrencyXchanger. At any time the head-office would know exactly how much the agent balance payable or receivable is. Also, the AML (Anti-Money-Laundering) checks that need to be performed to stay in compliance with your authorities are all provisioned in eWire.

Important to Note

eWire is not a remittance network and DOES NOT ACTUALLY TRANSFER ANY FUNDS

to any destination.

It is a record-keeping, tracking and control system for your remittance business.

You have to make sure that this method of money transfer is legal in all countries that you and your

agents operate.

CurrencyXchanger Pro is the perfect fit for the following businesses:

- Money Services Bureaus (MSB), Bureau De Change (BDC)

- Currency Wholesalers

- Money Remittance Agencies

- Cheque Cashing Companies

- Money Lenders and Pay-Day-Loan Companies

- Financial Institutions (Banks, Credit Unions, Holding companies, etc...)

- Dealers of Precious Metals

- Import & Export Companies

Common features of CurrencyXchanger Pro Edition:

- All the features of CurrencyXchanger BE Edition

- Beneficiary Bank Accounts

- Notification Warnings on Customers

- Wire (Money Remittance) (*)

- Electronic Messaging between agents (eMessage)

- Worldwide Agents

- Multi-user Collaborative Word Processor

- Beneficiary Accounts

- Online Banking for Customers (*)